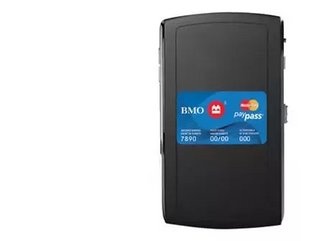

BMO Launches 'Tap and Go' Mobile Phone Payment Solution

BMO Bank of Montreal has announced the launch of its Mobile PayPass tag, a new technology offered to BMO personal credit card customers to make purchases from their mobile phone by use of a sticker affixed to the device which will relay instant email verification of each transaction.

This new technology offered by BMO will eliminate the need for customers to carry cash, and they may even be able to leave their wallet and purse at home. Customers will be able to just tap their phone over the PayPass reader at the point of sale and their purchase will be immediately processed to their BMO credit card account. Even more convenient, for purchases $50 and under, there’s no PIN number required.

To keep track of purchases, customers will have the option to opt into MasterCard’s inControl platform. With this service BMO’s Mobile PayPass Tag will alert customers of their spending by email with details of the merchant and exact location of the purchase.

SEE RELATED STORIES FROM THE WDM CONTENT NETWORK:

Click here to read the latest issue of Business Review Canada

“We know that Canadians’ use of cash for smaller-value purchases is based on their desire to get in and out quickly when buying day-to-day items like gas, a quick lunch or a coffee,” said David Heatherly, VP, Payment Products, BMO Bank of Montreal. "PayPass is part of the movement toward a 'cashless' society. It’s faster and more convenient than cash or debit, which requires a swipe and PIN.”

BMO believes this new PayPass technology will provide speed and convenience to its customers paired with a zero-liability purchase protection and anti-fraud capabilities already available on all BMO MasterCard products. The PayPass program will additionally allow customers to collect the same rewards that they earn on their credit card.

"Canadians tell us they prefer simplified, electronic payment methods. Given the prevalence of smartphones, and a quickly expanding network of PayPass merchants, we think mobile PayPass is poised to take off as a popular payment method for Canadians," said Scott Lapstra, Vice President, Emerging Payments, MasterCard Canada.

- BMO x Deloitte: Supporting Women-Owned BusinessesLeadership & Strategy

- BMO ranked in the top 100 most sustainable corporationsCorporate Finance

- Kony receives $37mn of financing from BMOLeadership & Strategy

- Bank of Montreal posts better-than-expected earnings in third quarterCorporate Finance