Canadians Stayed Within Holiday Budgets in 2011

The 2012 RBC Post-Holiday Spending Poll revealed today that a majority of Canadians stayed within their holiday budgets in 2011. With 69 per cent keeping holiday spending in check, Canadian’s concern over debt levels and their tracking spending within a budget are reasons given for why they were able to stay on track.

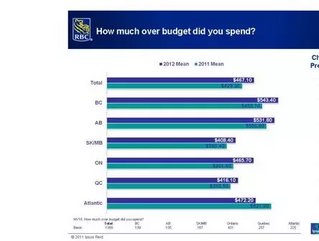

On the other hand, 31 per cent of Canadians expressed they had spent more than their allotted holiday budget, a downwards of two per cent from the previous year. Overspending an average $467 per person, those Canadians that were outside of budget spent $38 more than they did in 2010. The demographics of overspenders showed that women over the holiday were more likely to be generous with their budget while parents also spent more than planned.

"It's encouraging to see that the majority of Canadians kept an eye on personal debt and took a more cautious approach to holiday purchases," said Richard Goyder, vice-president of Personal Lending at RBC. "However, some Canadians went beyond their budget, meaning that there's still room for improvement when creating a budget and payment plan."

SEE RELATED STORIES FROM THE WDM CONTENT NETWORK:

Click here to read the latest edition of Business Review Canada

The RBC poll also found that holiday overspenders would have a more frugal January. 42 per cent planned to cut back on entertainment while 41 per cent expect to cut back on day-to-day living expenses such as groceries, phone and cable. In the end, 31 per cent of Canadians hope to give their credit cards a break in January while 31 per cent think cutting down their coffee trips will help them get back on track.

"There are ways to get into the spirit of the holiday season without breaking the bank and then having to deal with short-term fixes throughout the year," added Goyder. "The New Year is a great time to review your finances, get a proper handle on your debt load and set out a budget to pay it off and start saving."

When it comes to keeping within one’s budget, Goyder offered these important tips:

- Tackle your debt: Organize your debts in order of their interest rates and pay off the one with the highest interest rate first. Also consider consolidating all of your loans under one umbrella.

- Track and prioritize spending: Look at your monthly expenses to get a better idea of your daily spending. Include everything, even small items such as snacks and coffee. Prioritize your spending by looking at small adjustments that you can make easily before moving on to bigger items. Try to tuck away a fixed amount into savings or investments, such as a Tax-Free Savings Account or an RRSP.

- Use free online tools: Online debt calculators can help you track your overall debt and how this compares to your income and savings. These online tools are free and easy to use so that you can get a consolidated view of your full financial picture.

- Get professional advice: Speaking to a qualified financial advisor can give you a better idea of your overall credit situation and advice on what strategies you can use to reduce your debt load and stick to your savings plan.