PwC – shifting US attitudes towards ESG investment funds

A new report from leading consultancy PwC highlights the surging rise of environmental, social and governance–orientated (ESG) investments.

Asset and wealth management revolution 2022: Exponential expectations for ESG analyses the results of PwC’s global survey of asset managers and institutional investors. The findings reveal interesting regional outlooks and ten trends that stress the need for asset and wealth management (AWM) professionals to move away from ESG-orientated investments and instead imbed ESG principles into their processes.

The survey of 250 asset managers and 250 institutional investors accounts for around half of the global assets under management (AuM) – valued at around US$50 trillion.

The US perhaps unsurprisingly boasts the largest AWM market at around US$67 trillion and it seems attitudes there towards ESG products are changing faster than people may think The PwC survey suggests 81% of institutional investors in the US in ESG products over the next two years, which is similar to Europe, at 83.6%.

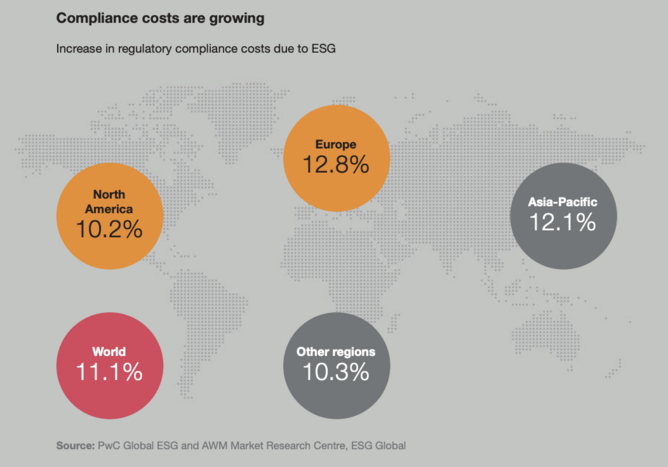

Compliance is driving shift towards ESG funds

High-profile commitments to fight climate change are seen as one of the drivers in the US, and the direction for investors seems clear, even if individual states have different attitudes to climate change priorities.

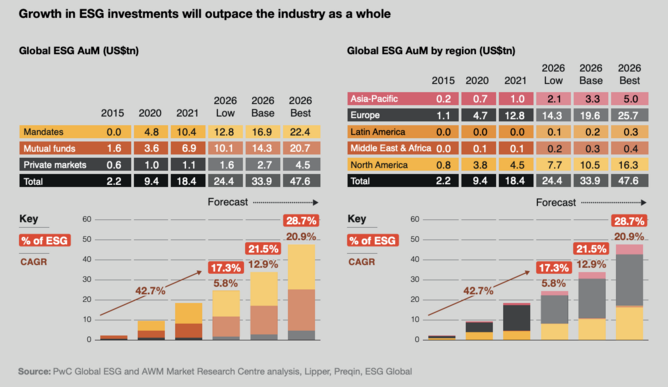

The survey predicts that Asia-Pacific will have the greatest percentage increase in ESG AuM, while Latin America and The Middle East & Africa are all rising fast – but admittedly lag far behind Europe and the US.

While this may sound like huge strides forward in APAC, it would still represent only US$5 trillion at best, compared to Europe on US$25.7 trillion and the US on US$16.3 trillion.

ESG AuM in Latin America would total just US$0.3 trillion, and the Middle East & Africa US$0.4 trillion.

PwC says the ESG-orientated AuM is set to grow faster than the AWM market as a whole – share of ESG assets over total AuM increasing from 14.4% in 2021 to 21.5% in 2026.

PwC highlights 10 key market trends shaping the ESG agenda in AWM

- ESG is replacing asset price increases as an engine of growth

- Pursuing ESG is fundamental

- The investible universe for ESG funds will open up

- ESG has broadened objectives and fiduciary duties

- Investors are pushing for new ESG products – but demand outstrips supply

- To attract new investment, managers will need to differentiate their products and demonstrate ESG performance

- Investors say they want more regulation

- A meaningful ESG strategy requires investment

- E, S and G must be balanced as part of a just transition

- Managers need a proactive risk-mitigation strategy for mislabelled products

READ the full report HERE.

- Why PwC is investing US$1 billion in artificial intelligenceTechnology & AI

- Gloomy economic outlook from PwC's latest global CEO surveyLeadership & Strategy

- PwC's Kathryn Kaminsky – the role of boards on social issuesLeadership & Strategy

- PwC's Norma Taki on driving female leadership and diversitySustainability