Manitoba Telecom Services sells Allstream to US-based Zayo Group

One of Canada’s leading telecommunications providers is changing the scope and shape of its business. Today Manitoba Telecom Services Inc. (MTS) announced that it is selling its subsidiary Allstream Inc. to U.S.-based telecom company Zayo Group Holdings Inc. for $465 million in a straightforward all-cash transaction.

RELATED CONTENT: Top Five Telecom Giants in North America

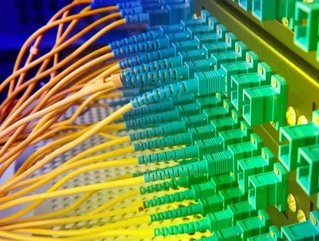

As a subsidiary of MTS, Allstream provides fiber optics-based IP, cloud and security solutions specifically for the business world. Zayo is a communications infrastructure supplier, specializing in fiber optics, bandwidth and cloud services, making it a perfect fit to take on Allstream. Meanwhile MTS has stated that this sale will allow it to better focus its strategies and operate as a “customer-first” telecom business.

“This transaction is the outcome of a comprehensive process which left no stone unturned,” said Jay Forbes, MTS President and CEO, in a press release from the company. “We engaged with a variety of potential strategic and financial buyers in a very orderly process. We believe this transaction maximizes the value of a stabilized and renewed Allstream, is in the best interests of the Company, and positions both MTS and Allstream for long term success in a competitive telecom marketplace.”

RELATED CONTENT: Learn how the cloud can help your small business

“We are delivering on our complete turnaround and planned exit from Allstream, with the value of the business fully recognized through a sale process we feel confident has a high certainty of closing,” Forbes added. “The acquisition by Zayo represents a new beginning for Allstream and a significant new evolution in the competitive landscape of Canadian telecoms.”

- Why ESG credentials should be central to your M&A strategySustainability

- Mergers & acquisitions are driving fintech innovationLeadership & Strategy

- McKinsey is looking to lead in sustainability space in 2022Sustainability

- Record valuations reached for M&A deals in 2021, says BainLeadership & Strategy