Americas fintech investment down from 2021 but still robust

Global investment in fintech fell to US$107.8bn in the first half of 2022 from US$111.2bn in the same period last year.

That’s according to KPMG’s 2022 H1 Pulse of Fintech report, which saw investment and deals decline in both the Americas and EMEA regions, while the APAC region attract a new annual high of fintech investment.

While it may seem that investment in fintech has fallen off a cliff so far in 2022, that’s simply not the case says Anton Ruddenklau, Global Fintech Leader, KPMG, explaining that 2021 was an extraordinary year with investors flocking to invest in the sector, and now we are simply shifting back to levels seen in 2019 and 2020.

“Taking out 2021’s outlier results, global fintech investment and interest was quite positive in H1 2022,” says Ruddenklau.

The US attracts vast majority of fintech investment in first half

Despite declining from 2021, the Americas region attracted the largest amount of VC funding (US$27.2bn).

The Americas started off the year particularly well and despite a dip in quarterly investment to US$22.7bn, saw a record 806 deals in the first quarter of 2022. But as geopolitical uncertainty and macroeconomic challenges picked up pace, total investment dropped to US$16.8bn across just 624 deals in the second quarter – bringing the investment total to US$39.4bn in the first half of 2022, down from US$59.7bn in the same in 2021.

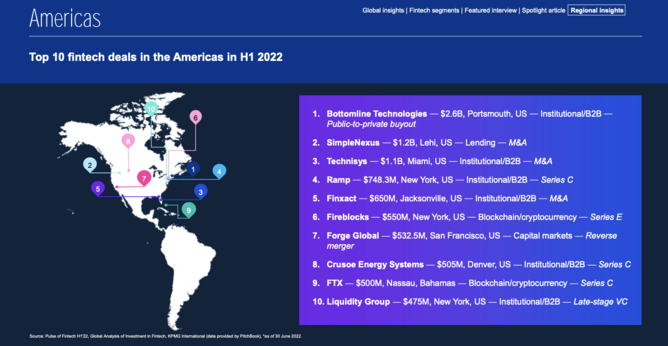

While the US saw declining investment, it did attract the vast majority of fintech investment in the Americas, accounting for US$34.9bn of investment. Among the biggest US deals were the US$2.6bn buyout of Bottomline Technologies by PE firm Thomas Bravo; US$1.2bn acquisition of SimpleNexus; and the US$1.1bn acquisition of Technisys by SoFi Technologies.

Brazil and Canada saw declines in investment greater than 50% with Canada’s investment dropping to a very low US$810m from US$1.9bn last year.

Given rising interest rates, increasing levels of inflation, and growing concerns about an economic recession, fintech investors across the Americas enhanced their focus on profitability, top-line revenue growth and cash flow when evaluating targets and companies within their portfolios. Investors have also started to consider the potential of companies to deliver returns given the changing market conditions.

Investment in crypto and blockchain slows, while payments and cybersecurity strong

After a record-breaking year of crypto and blockchain investment in the Americas during 2021, investment in the space slowed during the first quarter of 2022. While investment remained very strong compared to pre-2021 results, led by January raises by US-based Fireblocks (US$550m) and Bahamas-based FTX – the rest of the year could present more challenges for companies in the sector.

In contrast, investment in the payments space and cybersecurity is showing some resilience with M&A activity expected to remain strong as a result of increasing consolidation among payments firms and as the number and size of add-in transactions rises.

The US accounted for a strong portion of payments-focused fintech activity in the first half of 2022 both internally and in terms of driving cross-border investments in the sector.

As the world teeters on the edge of a recession, B2B solutions are also expected to become more attractive to investors.

Interest in the challenger bank market remains quite strong too. Banks are focusing on middle market consumers and small businesses — large populations seen as underserved historically. Interest in challenger banks is also growing in Canada, where the banking market has long been dominated by a small number of big banks.

“Most challenger banks will continue to expand into new markets and roll out new products and services in 2022, despite increased funding difficulties and some regulatory challenges in different jurisdictions,” says Courtney Trimble, Principal of Financial Services, KPMG US.

If they want to be successful, she says, challenger banks should focus on ensuring they’ve considered their compliant requirements fully even amidst the rush to be relevant in the market and the industry.

Looking to the second half of 2022 in fintech

According to the report, the second half of 2022 could see increasing interest from investors in M&A opportunities in the Americas as valuations come down and VC firms become more aggressive as fintechs look to raise additional capital.

“VC and PE firms have raised a lot of money, especially in the later half of 2021, so funds are still very liquid,” says Robert Ruark, Principal of Financial Services Strategy and Fintech Leader at KPMG in the US.

“As valuations come down and stabilise and investors become more comfortable with what the outlook looks like, we may see deal activity pick up, but investors are going to want to provide funding at much different valuations than they did before.”

Many will also want to extract more ownership out of their investments than maybe they’ve been able to over the last year or two, he adds.

KPMG’s 2022 H1 Pulse of Fintech report

- The Broadcom acquisition machine keeps on rollingLeadership & Strategy

- How the biggest deal in gaming history was finally completedTechnology & AI

- KPMG: The biggest challenges facing global CEOs in 2023Leadership & Strategy

- Insight strengthens European footprint with Amdaris takeoverTechnology & AI