How CEOs can navigate US inflation hikes, by McKinsey

Last year, there was a general consensus among policy makers, economists, and financial-market participants around the causes of rises in inflation. Coming off the back of the COVID-19 pandemic, it was easy to point the finger at that disruption as the reason, however CEOs told McKinsey that they saw this debate as being detached from the realities of business. Those CEOs said higher inflation was already “permanent enough” to start asking if a fundamental shift in how they led their organisations was needed.

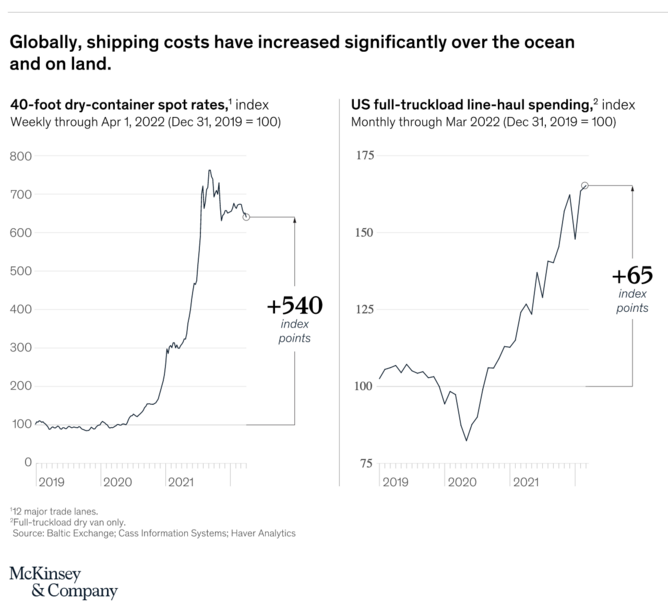

The first months of 2022 have seen unprecedented inflation rates not seen for decades, and well above the 2.0% target most planners and central banks strive for.

The consumer price index rose by 8.5% from March 2021 to March 2022 in the United States (a 40-year high), 7.5% in the eurozone, and 7% in the United Kingdom. Russia’s invasion of Ukraine have put extra pressure on supply chains and therefore inflation.

And just this week, the US Federal Reserve increased interest rates to their highest rate for 22 years as it fights to control spiralling prices.

Following an established inflation management playbook, central banks worldwide are raising interest rates, but is this having the desired effect?

Even if the central bankers succeed, progress will take time, says McKinsey.

How can CEOs guide their management teams, employees, boards, and a wide range of external stakeholders through this period?

Like central bankers, CEOs need an inflation management playbook. They can start scripting it by asking themselves and the senior leaders of key operational areas the following questions:

- Where will customers see value in this new environment? How can we design products, services, and experiences to deliver this value?

- What is the fastest way to stabilise and redesign stretched and, in some cases, broken supply chains? What capabilities will I need to increase my company’s resilience and control costs?

- What direction should I give to help procurement leaders create value?

- How is the new talent landscape affecting compensation, benefits, and workplace norms? What can I do to attract and retain employees in today’s shifting labour market?

- How should I pursue repricing in an inflationary environment? How can I form a through-cycle and strategic mindset for my customer relationships?

- How can I set priorities and organise to direct all this activity?

The CEO is an organisation’s ultimate integrator. McKinsey’s research into the behaviours and mindsets of excellent CEOs shows the pivotal role that chief executives play in setting a clear direction, aligning the organisation, managing stakeholders, and serving as “motivator in chief.”

The best CEOs act boldly, but also approach important decisions by listening first, treat ‘soft’ culture topics as a hard material advantage, empower employees, and ask questions constantly.

Here are McKinsey’s key points for CEOs to navigate inflation, with a focus on supply chain and procurement.

Build digital, integrated, transparent and agile supply chains

The logistics of carriers and disrupted supply chains had once been the exclusive domain of spreadsheet managers. Today they are standard topics around C-suite and boardroom conference tables. McKinsey see several critical issues that CEOs should push their teams to pursue aggressively.

- Make your entire supply chain visible

- Identify and manage potential supply chain risks

- Make seamless end-to-end planning a CEO priority

Transform procurement to create value, not just cut costs

CEOs are beginning to recognise that purchasing leaders can be full-fledged strategic partners by expanding their focus from the cost of goods sold (COGS) to creating value and helping the enterprise succeed. In response to these needs, procurement leaders have implemented, in weeks, actions that previously would have taken months and years.

Some examples include:

- Expanding focus to “everything is in play.” In response to the scarcity of contracted labour and higher prices from suppliers, the supply chain team of one electric utility partnered with procurement to redesign end-to-end engineering and construction workflows. This change tightened governance, maximised demand, simplified requirements, changed how work was allocated, and put in place new contractor management processes. These moves all helped to ease inflationary pressures.

- Basing contracts on the current reality. An industrial manufacturer faced across-the-board cost increases from suppliers. In response, it documented every such rise in fine-grained detail to better understand the exact cost drivers of each product or service, to improve internal cost models, and to build better contracts indexed to the right commodities and input costs.

- Rethinking logistics and geographic sources. Facing challenges to product deliveries from Asia, one electronics manufacturer increased sourcing of production in the United States and Mexico. Another purchased its own fleet of aircraft to deliver products from Asia to end-user markets.

- Considering vertical integration. Retailers are making acquisitions to control value chains for key products. Automotive manufacturers are contracting directly with foundries to reserve capacity. Energy producers and utilities are exploring investments to onshore the manufacture of key production components for renewable energy.

- Investing in technology and process automation. Taking a page from law firms, a mining company shifted its technical-services contractors to 15-minute increments for billing and gave them the technology needed to track their time. By minimising the rounding up of hours, the company saved 5 to 8% of costs across contractor trades.

Read the full report Navigating Inflation: A new playbook for CEOs

- KPMG: The biggest challenges facing global CEOs in 2023Leadership & Strategy

- What will the C-suite of tomorrow look like?Leadership & Strategy

- All change as Kinaxis announces trio of C-suite appointmentsLeadership & Strategy

- Why employee wellbeing is more critical in uncertain timesLeadership & Strategy