Uruguay is most promising market in Americas for 2022

The South American country of Uruguay offers the most promising opportunity for investors and exporters in the Americas this year, Atradius research finds.

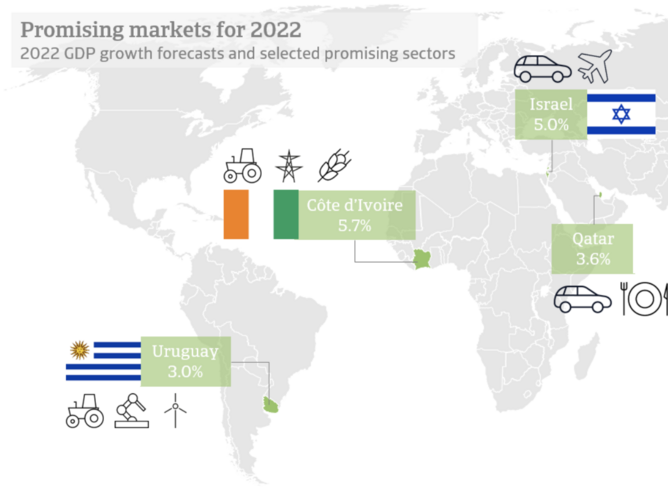

Atradius’s 2022 Most Promising Markets report identifies five global markets set to surprise in the months ahead, including Uruguay, Israel, Qatar, Cote d’Ivoire, and Taiwan.

While the global economic recovery from the pandemic is bumpy, the economies of Israel and Qatar are recovering well and their outlooks generally well-insulated from negative pandemic developments thanks to extensive vaccination rollouts and/or low infections rates.

The resumption of economic activity is contributing to brighter prospects in the tourism and hospitality sectors while the acceleration of digital adoption for consumers is keeping up demand for transport and logistics. The global energy transition is also driving policy initiatives in several of these markets, pushing up demand in the renewable energy and electricity sectors, especially for EVs.

Atradius assessed the economic performance, macroeconomic strength and Covid-19 situation of countries worldwide.

Uruguay – strong institutions and shock resilience

With 3.0% growth in real GDP forecast, Uruguay’s economy will surpass its pre-crisis levels in 2022. Government policies implemented in Q4 2021 including a reopening of borders, the elimination of value-added tax (VAT) for tourists and loans to stimulate the tourism sector – which accounted for 17.4% of Uruguay’s GDP in 2019 – will support growth this year.

While Latin America has been the hardest hit region by the pandemic, prioritisation of the vaccination rollout has ensured that 77.3% of Uruguayans are now fully vaccinated. This should support 3.6% growth in private consumption in 2022. Demand for automobiles and electronics, in particular, is expected to be strong, offering growth opportunities in those sectors.

Next to tourism, Uruguay’s other main sector is food, including agricultural and meat production. Exports in these sectors are expected to grow substantially this year, barring adverse weather conditions, and producers are benefitting from higher food prices.

To meet this growth, Atradius expects demand for machinery to support farming activities to be high. Uruguay’s large agricultural sector is however vulnerable to adverse weather conditions though as climate change raises the risk of droughts in the region. In response, authorities are increasingly investing in the renewable energy sector and the country is becoming a major exporter of renewable energy, especially wind-generated, to the region.

Uruguay is also facing rising prices, but the country has strong shock resilience. Inflation, at 8.0%, has surpassed the upper bound of the central bank’s current target range of 3% to 7% and is expected to remain above this through the year. The central bank is accordingly hiking interest rates and the tightening cycle may be quicker than expected, depending on US monetary tightening, to prevent peso depreciation and capital. Atradius expect this to remain an orderly process in 2022 thanks to strong institutional quality and a considerable level of international reserves.

Uruguay is one of the strongest democracies in the world, with a stable political and business environment, underpinning its robust outlook.