What do the world’s most resilient companies have in common?

Running a company today is arguably the toughest it has ever been.

From the Covid-19 pandemic and the Russia-Ukraine war to climate change, technological challenges and the threat of a looming recession, the level of disruption facing leaders is at an all-time high.

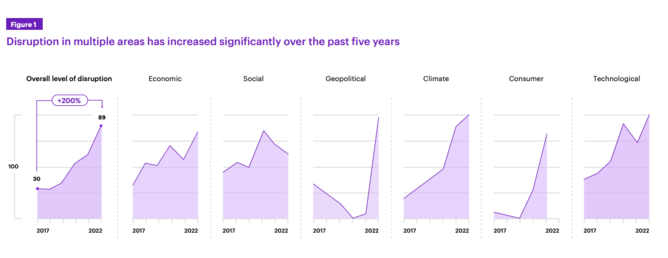

Disruption levels increased a staggering 200% from 2017 to 2022, compared to just 4% from 2011 to 2016, according to Accenture’s Global Disruption Index.

It’s little wonder then that 65% of executives consider today’s business environment more challenging than in the past, or that a staggering 93% of CEOs are dealing with 10 or more global challenges to their business.

And the shocks and disruptions are only likely to keep coming.

To not just survive amidst such disruptions, but thrive and emerge stronger, leaders must invest in building company resilience, Accenture’s new Reinventing for Resilience report finds.

But what makes a company in today’s complex business world resilient? What makes one firm survive when another fails, one company thrive where others struggle?

Traits of long-term profit-making companies

To discover the true traits of sustained growth and profit-making, Accenture analysed 1,165 global firms, subsequently identifying 15% of companies who excel in this way.

Dubbed ‘long-term profitable growth’ companies, this small group of global firms not only recover faster and emerge stronger after disruption or crisis, delivering profitable growth before, during and after disruptive events, but consistently outperform industry peers, extending a lead over competitors by 5 percentage points from 2017 to 2022.

Analysis shows that not only do these companies show higher resilience during crisis, but they actually extend their lead and widen their performance gap during and after the crisis period.

What differentiates these high performers is their balance of strength across financial, business, sustainability, talent, and technological dimensions of the business – proving that every capability is crucial.

Not only do they score 40 percentage points higher in financial and customer-related performance, but 21 percentage points higher in sustainability and 12 percentage points higher in technology.

Drawing on a 20-plus year career advising the world’s largest companies on their business strategies, Muqsit Ashraf, global lead for Accenture Strategy, says leaders can help build or reinforce their organisation’s resilience by taking a balanced approach.

Holistic balance and strong financial discipline key

Such an approach combines foundational capabilities such as financial discipline, a strong digital core, and a robust talent strategy with investments in key business capabilities such as supply chain, sustainability, and customer experience.

“By doing so they can extend their resiliency premium – their performance advantage over industry peers – through cycles, in particular, disruptive ones.”

Ashraf recommends companies maintain a strong balance sheet, allocating capital with consideration of short-term gain and long-term performance.

“Establish a robust set of checks and balances to manage cost structures, minimise financial risk and invest in transformation without over-extending,” he says.

Adopting a holistic approach is also recommended, which means simultaneously investing in key business capabilities that drive resilience.

As well as advancing a strong ESG agenda to attract the right talent and enhance consumer perception, Ashraf recommends developing a customer-centric commercial operation to increase loyalty and enhance experiences for new and existing customers. Not to mention, continuing to strengthen the supply chain and operational capabilities to cope with future distress and shocks.

Invest in new technologies (and talent)

Unsurprisingly, long-term profitable growth companies outscore their low-growth, low-profitability peers by a significant margin on the technology front too.

These companies not only consistently invest in new technologies, innovation and cybersecurity, but they pair it with strong business capabilities to ensure a return on dividends.

Put simply, top-performing companies focus on building a strong digital core not only to strengthen their technology capabilities, but also to upgrade capabilities across all business functions. They have a strong digital core embedded across the enterprise.

And this is amplified further still when combined with a robust talent strategy – companies that combine high scores in technology and talent increase their profitability of becoming a long-term profitable growth company by a factor of four, the report finds.

Moreover, recent Accenture research reveals that companies that leverage the full potential of data, technology and people stand to gain a premium of up to 11% in top-line productivity.

Despite this, just 5% of companies are bringing these elements together in a powerful way, indicating there is opportunity to do more—even among high-performing companies.

Accenture recommends that CEOs prioritise early investments in core digital capabilities and talent by leveraging the power of cloud, data and AI, including disruptive advancements like generative AI to drive agility, innovation and transformative change at scale.

A human-centric approach is recommended, integrating with and enhancing the talent strategy and focusing on diverse teams who are skilled to address today’s challenges.