Less than 20% of retailers on track to hit green goals, BCG

When it comes to delivering on sustainability, the retail industry is sorely lagging, according to a new study by Boston Consulting Group, in collaboration with World Retail Congress.

The just-released report, titled ‘Sustainability in retail is possible, but there’s work to be done’, found that while sustainability is now a strategic priority for retail businesses, the vast majority are failing to make meaningful progress with less than 1 in 5 retailers on track to hit their sustainability goals.

The findings reveal that among the retail businesses surveyed there is widespread understanding of the competitive advantages to winning in sustainability, including having a competitive edge over rivals, cheaper borrowing, lower costs, attracting new customers, and retaining employees, as well as the potential for tapping into new revenue streams.

However, the survey also found that the companies were “nearly unanimous” in believing that sustainability initiatives would drive value in the next 5-10 years and half of the respondents believed their companies would invest “whatever it takes” to reach their goals.

The BCG findings revealed that there was a clear disconnect between retailers’ bold ambitions and their progress on the sustainability journey.

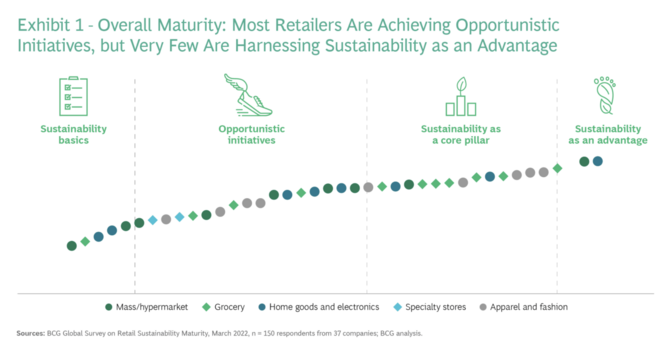

Only a select few of the companies had reached the stage where they could claim sustainability was core to the company’s strategy, decision making, and value creation.

While 60% believed their company’s goals were bold and differentiated, more than half had still not set any sustainability key performance indicators (KPIs) across their businesses to measure progress, and less than 20% were currently on track to cut Scope 3 emissions, which include those of suppliers, by enough to meet targets for limiting the rise in global temperature to 1.5 degrees, set by the Paris Agreement in 2015.

Some companies are stuck at “sustainability basics,” simply doing enough to comply with regulations and meet the minimum expectations of investors and other stakeholders.

Retailers must prioritise, embed and reimagine – BCG

The report highlights the need for a fundamental shift in attitudes and business processes to place sustainability at the core of corporate strategy, decision-making, and value creation. Firms need to do more to augment and accelerate their responses to tackling issues such as plastic packaging, which accounts for 40% of global plastic use.

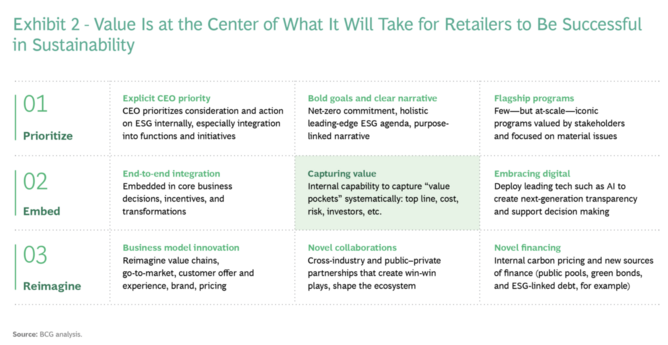

To translate this value mindset into value creation, retailers need to work on having the rest of the principles in place. As a solution, BCG presents a three-pronged strategy:

- Prioritise – Sustainability targets should carry as much weight as other parameters when embarking on new business opportunities as well as when evaluating business performances, and sustainability indicators must be weighted equally with costs and profits. Leadership must not only sponsor the journey but be involved and accountable.

- Embed – Retailers should strive for end-to-end integration, with sustainability-related KPIs inculcated at all levels of the business. Companies should also fully embrace digital technologies, deploying technology to support decision making through newly created transparency.

- Reimagine – Companies must reimagine their value chains. This can be done by localising their production or integrating vertically. Closer interactions with suppliers will be essential too, as will collaboration with industry peers.

“As the industry moves in the direction of greater sustainability, a focus on progress, rather than perfection, will be critical,” says Ian McGarrigle, Chairman of World Retail Congress.

While there may be the inclination to wait for perfect data on sustainability drivers and constraints before starting to act, Shalini Unnikrishnan, a partner at BCG, says this “would be a mistake”.

Companies in the very early stages of their journey should focus on small steps and quick wins. Together, these will drive steady and meaningful change that creates significant value for both individual players and the industry.

The study concludes that industry-wide collaboration will be critical to progress, with those lagging able to learn from leaders and retailers seeking opportunities to work together to solve common problems.