Gartner: Global IT spending to total US$4.1 trillion in 2021

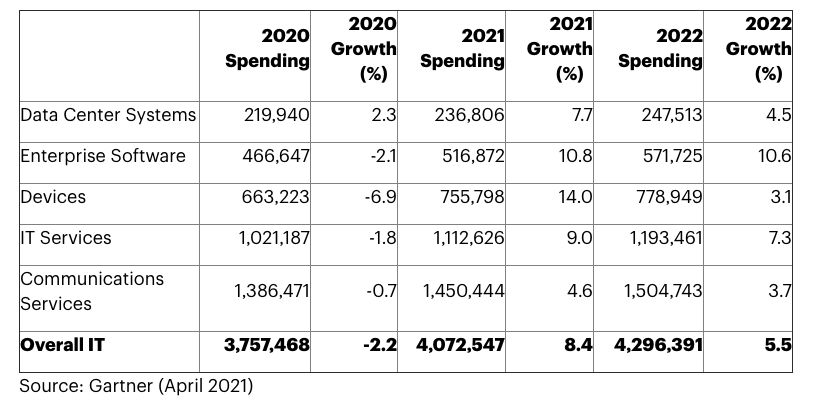

Global IT spending is projected to total US$4.1 trillion in 2021, according to Gartner, an increase of 8.4% from 2020.

The spending for new digital innovations and initiatives will increasingly come from departments outside IT, Gartner reports, with IT no longer simply supporting corporate operations as has traditionally been the case, but fully participating in business value delivery.

According to John-David Lovelock, research VP at Gartner, this shifts IT “from a back-office role to the front of business” and also “changes the source of funding from an overhead expense that is maintained, monitored and sometimes cut, to the thing that drives revenue.”

What will be the focus of IT spending?

Gartner forecasts all IT spending segments to have positive growth through 2022 with the highest growth coming from devices (14%) followed by enterprise software (10.8%) due to the business shift to remote and hybrid working, as companies aim to offer a comfortable, innovative and productive environment for their workforce.

In particular, states Gardner, expect to see an increased focus on the employee experience and wellbeing, which are propelling technology investments forward in areas such as social software and collaboration platforms and human capital management (HCM) software.

The focus for CIOs through the rest of 2021 will be completing the digital business plans aimed at enhancing, extending and transforming the company’s value proposition.

“Last year, IT spending took the form of a ‘knee jerk’ reaction to enable a remote workforce in a matter of weeks. As hybrid work takes hold, CIOs will focus on spending that enables innovation, not just task completion,” adds Lovelock.

Spending recovery industry and region-specific

Recovery across countries, vertical industries and IT segments still varies significantly, prompting a K-shape economic recovery, states Gardner.

Banking and securities and insurance spending will closely resemble pre-pandemic levels as early as 2021, while retail and transportation not witnessing the same recovery until closer to 2023.

In terms of regional spending, while Greater China is already showing evidence of surpassing 2019 IT spending levels, North America and Western Europe are expected to recover in late 2021, while Latin America in 2024.