Mastercard: committed to transparency in digital banking

In an announcement made by Mastercard, the company has reported its further commitments to providing transparent digital banking applications.

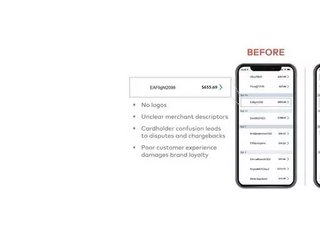

With research showing that 6% of consumers want more details to help them easily recognise a purchase, as well as nearly 25% of transactions disputes being avoidable as a result, Mastercard has developed a new initiative to increase transparency.

The initiative managed by Ethoca - a fraud and dispute resolution technology company - aims to eliminate confusion and improve customer experience. The initiative is encouraging merchants to visit its site - logo.ethoca.com - and upload their logos to be used in online banking and payment apps.

The logos will be linked to the corresponding transactions, in order to provide a clearer visual for quick identification of purchases. Those that participate benefit from the opportunity to extend their presence and eliminate expensive and time consuming chargebacks. The initiative will be available to all financial institutions.

“With greater digital dependency, having real-time purchase details is critical for consumers, merchants and card issuers alike,” commented Johan Gerber, executive vice president, Cyber and Security Products at Mastercard.

“We continue to collaborate with industry partners to bring clarity and simplicity before, during, and after transactions. By enriching transaction details, merchants can alleviate friendly fraud, reduce chargebacks and improve the customer experience.”

This collaborative initiative comes as part of Mastercard’s efforts to provide the most efficient, safe and simple payment experience throughout their entire journey, and is the latest edition to Mastercard’s Click to Pay checkout experience, its use of biometrics for secure digital and physical transactions and Ethoca’s digital experience solutions.

For more information on business topics in the United States and Canada, please take a look at the latest edition of Business Chief North America.

Follow Business Chief on LinkedIn and Twitter.

Image source: MasterCard