Competition fierce for fintech talent, reports Barclays

A new report from Barclays Corporate Banking says main players in the financial services industry are re-evaluating their growth strategies as the battle for top talent grows more significant.

Research from Barclays in the Strength in Numbers report finds fintechs expect disruption from start-ups and are looking overseas for payments innovations.

Barclays surveyed nearly 1,000 financial services leaders from across EMEA, the Americas and Asia-Pacific in 2021.

Growth is still the top priority for 23% of global fintechs, but that is down significantly from the 57% cited last year.

FinTechs are now looking to prioritise increasing profitability (8%), conducting acquisitions (7%), enhancing cross-border operations (7%) and redefining target markets (4%).

Talent acquisition has also risen rapidly up the agenda to now be the second most pressing area across EMEA, the Americas and Asia-Pacific. More than one in ten fintechs have no greater priority than securing talent to grow their businesses.

“It’s essential to understand that the battle is no longer just for coders and technical payments people,” says Jenni Himberg-Wild, Head of FinTech and Non-Bank PSPs, UK, at Barclays Corporate Banking.

“As the market continues to mature, there is increasing demand for people with a real breadth of experience. We are seeing firms looking at IPOs, for example, and they are looking to add people with broad business experience, bolstering their boards and adding credibility.

“The competition is now fierce. As these businesses mature and evolve, it is not enough to just bring in new tech. Talent is essential to the continued growth of these businesses.”

Fintech start-ups will play an increasingly important role

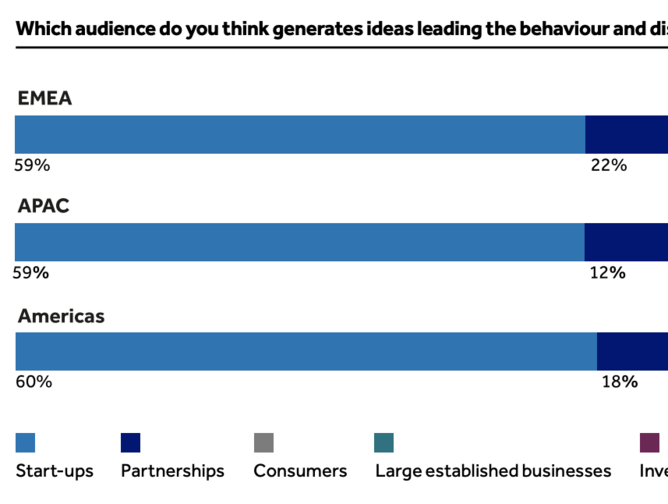

Some 60% of fintechs say the ideas leading the behaviour and disruption of the payments industry come from startups, identifying them as key drivers of disruption and change. This is up from 53% in 2020.

Large, established businesses were cited by respondents in Asia-Pacific as being the second most important driver for change (at 18%), but were only cited by 5% of respondents in EMEA and Americas. Barclays suggest that the reason for the higher response in Asia could be down to the fact the market is dominated by a few large players with a higher profile.

Fintechs more likely to look abroad for payments innovation

Previously, fintechs had said that payment innovation would overwhelmingly come from their own regions, but there has been a marked shift in that view, with many regions looking overseas for innovations in payments.

In 2020, home bias was particularly strong in Asia-Pacific, where China, India, Japan and Southeast Asia together claimed more than 83% of regional votes. However, in 2021 these countries only accounted for 36% of Asia-Pacific responses, with respondents opting for other regions instead.

UK respondents took a similar perspective, as three times as many respondents identified Asia-Pacific as the next source of innovation (12%) than Western Europe (4%).

“What is clear from this report is that the positivity and confidence that we have seen among FinTechs in the previous two years has not only continued but has grown,” says Sabry Salman, Global Head of Financial Institutions and Non-Bank PSPs at Barclays Corporate Banking.

“This optimism is underpinned by an apparent maturing in the market, which is demonstrated on numerous levels.

“Fintechs’ outlook on growth, for example, has matured beyond a simple focus on seizing the opportunities created by the pandemic – their overriding focus according to last year’s report. We are seeing a return to the far greater investment in strategic growth drivers we saw before the pandemic, and with even greater gusto – with more attention being paid to cross-border activities, acquisition, and internal changes to support new working models. Firms are now focused on more sustainable and longer-term growth opportunities.”

Read Barclays Corporate Banking’s report.