Deloitte – Trends in corporate travel in 2022 and beyond

After two years of reduction to less than a quarter of its 2019 size, corporate travel is expected to climb back steadily in 2022, according to Deloitte’s new corporate travel report, Reshaping the landscape.

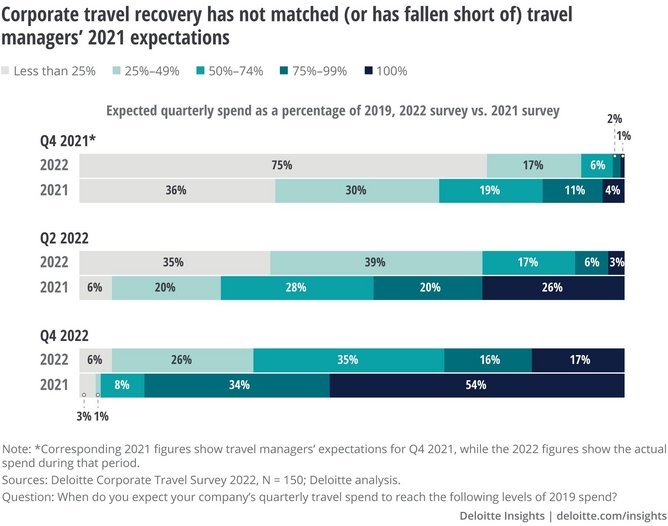

Currently below 50% of pre-pandemic spend, the corporate travel sector faces a more complex prognosis than leisure, with growth falling far short of pre-pandemic levels at the end of the year.

Only 17% of travel managers expect a full recovery by the end of 2022, versus more than half of the respondents to the 2021 survey. The experience of the delta and omicron variants partly explains this less optimistic outlook.

Spend is projected to reach 35% of 2019 levels in Q2 2022, and 55% by the end of the year. Many of the international trips that do happen will involve a transatlantic flight.

Europe leads destinations for US-based travellers, with nearly one in four companies saying frequency will near or exceed pre-pandemic levels. Asia and Latin America follow in recovery expectations but remain far behind Europe. More than half of companies with reasons to visit Africa, the Middle East, or Oceania expect no or very little travel to those regions in 2022.

The top driver for a return to international travel aligns is sales – 43% of respondents rank sales visits among their top two reasons for sending travellers overseas in 2022. Leadership meetings (32%) and client project work (31%) follow in importance.

So, while this year will see steady gains in transient corporate travel, and barriers to international travel should continue to recede, business travel is at least two years from reaching pre-pandemic spend, as some travel use cases are expected to spur fewer trips over the long term.

Deloitte predicts that by 2023 companies should begin to settle into their post-pandemic travel norms.

That travel may look quite different however, having given birth to long-term shifts and short-term trends – demonstrating the financial savings and environmentally friendly practices realised from two years of very limited travel and the effectiveness of technology to replace a significant amount of travel, saving firms money.

WFH brings new use cases but less travel

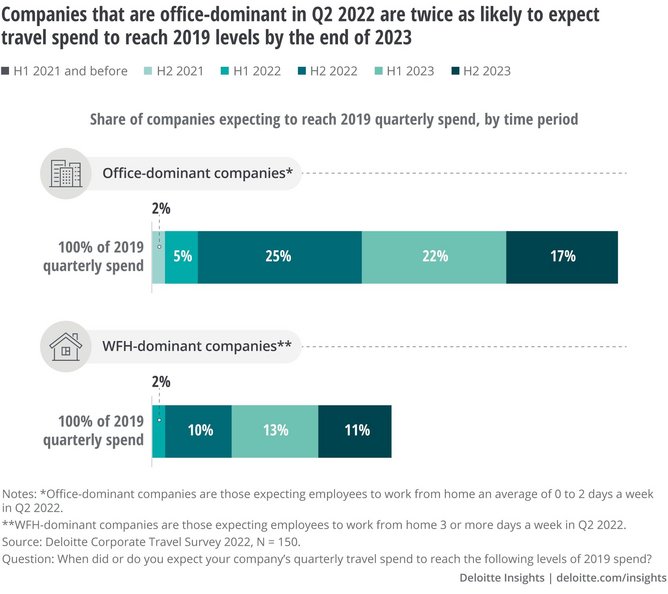

Workplace flexibility is here to stay, and so are its effects on corporate travel. While return-to-office plans are poised to ramp throughout 2022, travel managers expect their companies’ future rate of WFH to average 2.5 times as much as pre-pandemic.

Companies returning to the office in a bigger way also expect to increase their travel spend faster, among those where the average employee comes to the office at least three days a week by the second quarter of 2022, 71% say their travel spend will recover to pre-pandemic levels by the end of 2023.

The persistence of flexible working will necessitate more trips to company headquarters. One in four say they expect additional trips to headquarters, and airlines may find some incremental demand serving routes between established business hubs, while hotels in the right locations will have opportunities to offer attractive amenities for long stays.

Sustainability will push against future corporate travel spend

A new commitment to sustainability joins a much older commitment to cost containment, and together they will likely increase scrutiny of return on investment.

To keep costs under control, nearly three in four companies say they will limit the number of trips taken, while three in 10 companies expect their own commitments to sustainability to cause an 11%-25% reduction in travel budgets by 2025.

For the more than 400 companies that signed a pledge at 2021’s Davos World Economic Forum to decarbonise by 2050, keeping a check on travel’s rate of return will help them meet their commitments. Beyond this, one-third of travel managers surveyed say their companies have pledged to reduce carbon emissions by a specific amount within a specific time period.

And technology along with behaviour changes brought on by two years of mainly virtual meetings and events has made it easier for firms to cut back. Transitioning more meetings online, restricting travel frequency, and reducing flights taken and long-haul trips are the steps that the largest number of companies plan to take.

Many companies are looking for sustainable partnerships, with one in three saying they are seeking guidance from travel management firms on how to reduce their carbon footprint, while 25% plan to prioritise travel suppliers that invest in sustainability.

Exceptional experiences will be focus for conferences and events

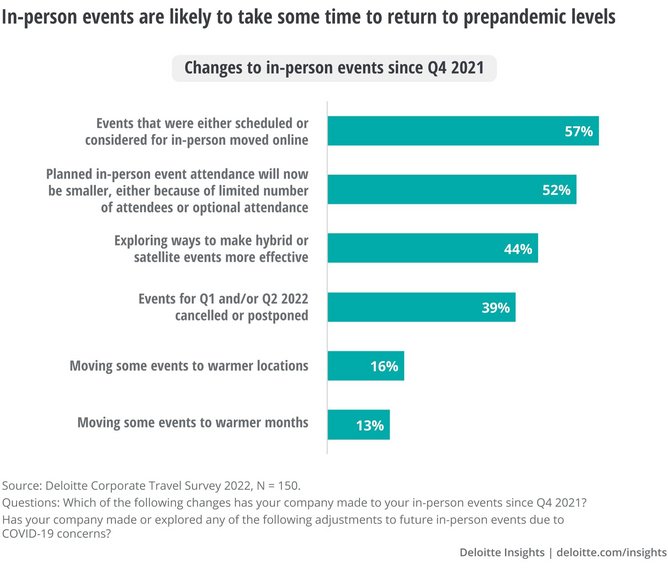

Conferences and events, which should see a resurgence domestically in 2022, face another challenging year attracting international delegates, with spend indicating the industry will not quickly bounce back to its pre-pandemic size. Nearly three in four (72%) say their firms will spend less on external conferences than in 2019.

That said, some improved attendance is expected as businesses feel their absence after two years of cancellations and online-only formats. Companies are taking a rigorous approach, prioritising the most constructive events, monitoring who and how many attend, seeking events with a powerful mix of networking and content and taking a greater interest in exceptional experiences. They also are making adjustments to their own events., and more than half have adjusted downward their attendance expectations. A much smaller number are moving events to warmer locations and months, which could have a lasting effect on demand for conference venues.

When it comes to conference content, travel managers are less confident about tech replaceability, compared to Deloitte’s 2021 survey. Live events moved up three spots among triggers to increase travel, entering the top five (out of 10), with travel managers saying they continue to place high value on the networking that takes place at these events, and which they feel ill-served by virtual formats.

Alternative lodging options

The pandemic has been a boon to private rentals, as travellers seek distancing from others and more space for families and workstations. Airbnb’s earnings climbed 38% from Q4 2019 to Q4 2021.

And these alternative lodging options are finding their way into corporate travel albeit still at a nascent stage. About one in 10 companies have non-traditional lodging in their booking tools. But half of the companies surveyed do not even reimburse employees for stays in non-hotel lodging.

Deloitte’s research shows that the pandemic is creating a large number of new rental travellers, who plan to continue staying in rentals after the pandemic. Some business models are targeting corporate travel with standardised offerings in urban locations and high-end properties that can accommodate retreats for small teams. If these models continue to expand, or if a major rental player creates a targeted business product, rentals could increasingly appear in corporate booking tools.

For more traditional hotels, two years of depressed demand, accompanied by challenges attracting and retaining frontline workers, has led to cutting back on services and amenities. While hotels will no doubt do their best to provide stellar service as corporate travel increases, the challenges remain.

Some corporate travel buyers are turning to their contracts to ensure the best possible onsite experience for their teams, introducing clauses into meeting contracts that specify the availability of amenities during their events. Twelve percent of travel managers involved in meetings contracting say their companies have successfully added such clauses. And more than four in 10 have considered such clauses but have not successfully implemented them yet.

- Deloitte’s bold Project 120 is changing the face of L&DLeadership & Strategy

- Inside Deloitte and Google’s expanded strategic allianceTechnology & AI

- Business travellers taking steps to reduce carbon footprintSustainability

- Deloitte reveals work priorities for Gen Z and MillennialsHuman Capital